Order Fulfillment Funding

WHAT IS ORDER FULFILLMENT FUNDING?

Order Fulfillment Funding (OFF) is a type of commercial financing that allows a business to receive funding for a pre-ordered sale or project using the invoice or purchase order from the client as collateral. Many times, new, small or growing businesses will not have the funds on hand that they need in order to purchase all of the materials necessary to fill an order, nor can they obtain credit from a traditional financial institution. Black Connect is helping to close the funding gap for Black entrepreneurs & business owners.

“Even if they survive the start-up stage, Black-owned businesses still disproportionately struggle with debt and raising capital. Black entrepreneurs are three times as likely as white entrepreneurs to say that a lack of access to capital negatively affects their businesses’ profitability and almost twice as likely to cite the cost of capital.”

FAQ

Having access to capital is key to maintaining continuity or taking your business to the next level. So if you’re a Black Connect member, Black Connect’s Order Fulfillment Funding (OFF) helps to break down a barrier to entry into entrepreneurship and business ownership with micro-funding. OFF helps Black Connect’s Entrepreneur and Small Business members satisfy orders, maximize profits, and free up their cash flow.

+ What are the funding limits?

The maximum amount of funding is $3,000 per transaction, based on the availability of funds. This program may close temporarily when all of the funds have been allocated.

+ What are the funding requirements?

- You must be an entrepreneur/sole proprietor or small business/non-profit member of Black Connect

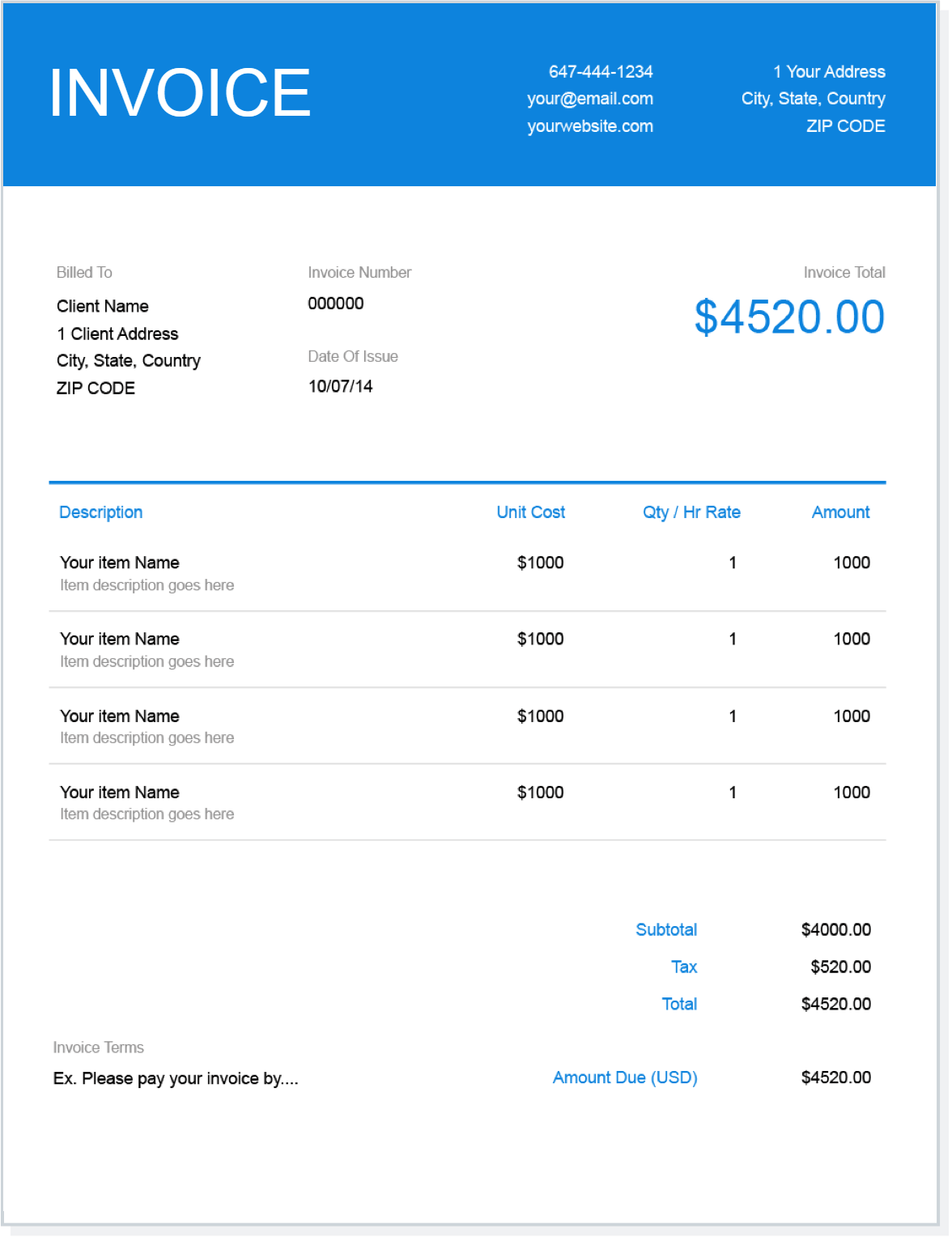

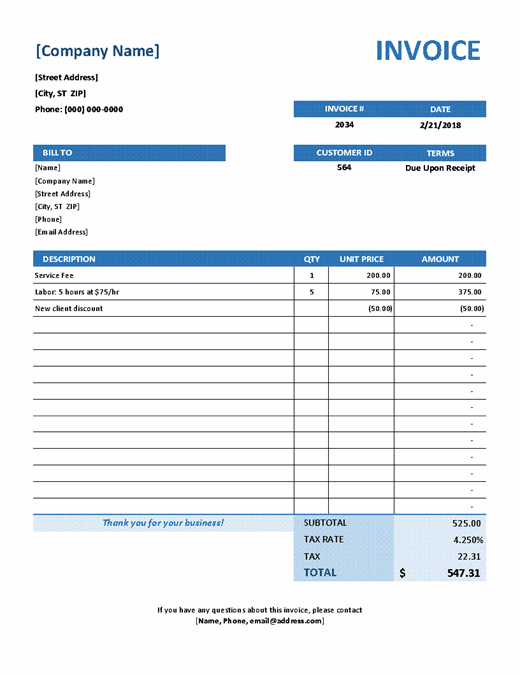

- You must complete the application and submit all of the required documentation

+ How does OFF work?

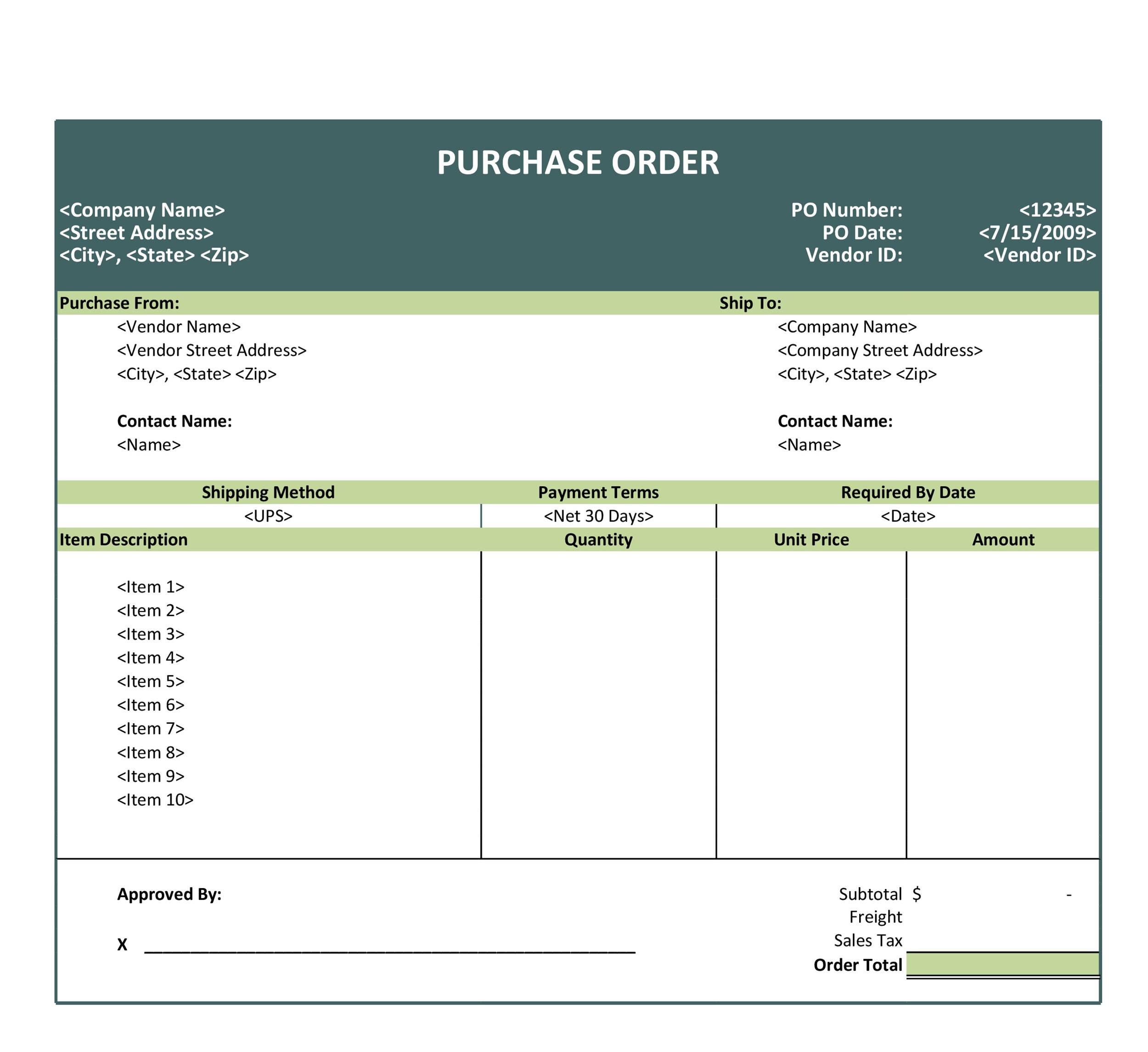

- Your customer places an order with you

- You get a quote from your supplier

- You complete the application for funding and provide the requested documentation. If approved, Black Connect will fund up to $3,000.

- You pay any portion of the supplier's quote that is not covered by OFF.

- Black Connect sends approved funding directly to your supplier.

- The supplier fulfills the order and the order is delivered to the customer.

- Rather than pay you, your customer will pay Black Connect directly.

- Once Black Connect deducts the principal and the funding fee, we’ll send you the remaining balance. Black Connect does not charge interest on the funding.

+ How much does OFF cost?

First, it’s important to understand that order fulfillment funding is not a loan. So, this type of financing doesn’t actually come with an interest rate. Instead, Black Connect will charge you a one-time fee of five percent (5%) of the principal amount for which you are approved. You do not pay the fee up-front. Instead, the fee is deducted from the funds that are paid by your customer. You can consider factoring the OFF fee into the amount that you charge your customer. The gross margin on the transaction should be at least 20%, if not more.

+ How long does it take for funding to be approved?

Many things will be considered during the review process including risk, type of product/services rendered, number of days it will take to get it delivered, transaction history between your supplier and you, and gross margins. You will typically receive a response within 7 business days after you submit all of the requested documents and information.

+ Why do businesses use order fulfillment financing?

- Maintain customer relationships: Fail to meet an order, and you risk losing a customer.

- Fulfill larger orders: Be able to accept larger orders than you would if you depended only on your cash on hand.

- Cover cash flow gaps: If you’re experiencing a cash constraint, you’ll need a way to free up working capital.

- Finance seasonal sales spikes: Demand may spike during specific periods of the year, - i.e. Mother’s Day, Christmas, Valentine’s Day, etc. and you may need help to finance the orders.

- OFF isn’t a loan, so you utilize the funds without having to make monthly payments.

- Black Connect has lenient requirements for our members, making it easy to qualify even if you have no credit history, a low credit score.

- No collateral is necessary — the purchase order itself satisfies this security.

- You can secure funding without selling equity in your company

- New or small companies may have access to funding even if they might not yet be able to qualify for a loan from a traditional financial institution. Unlike many other types of business funding, Black Connect’s OFF is open to startups.

Funding Worksheet

Submit the completed worksheet with your funding application

Questions? Email funding@blackconnect.org

“60% of small business owners worry about cash flow problems every month”